By Srividya Amanchi

India is among the top countries in mineral wealth. As many as 90 distinct minerals are to be found here, varying in geographical distribution and economic significance. This is the complete the story of India’s mineral wealth, history of minerals, green mining, and sustainability goals of the country.

The mining sector in India is an important part of the Indian economy. Since independence, the mining industry has been showing pronounced growth, today contributing about 2-2.5% of the GDP.

India’s economic growth rate highly depends on the mining sector due to its largest production rate, scope for exploration, and huge mineral resources in many states, some of which are still unexplored areas. Surprisingly, only 10% of India’s geological potential mining blocks are explored, indicating the untapped potential of the sector. The reserve-to-resource ratio in the country is significantly lower than the ideal 50%, suggesting a gap in mineral exploration and extraction.

Mining underwent modernisation since India got independence in 1947. The economic reforms of 1991 and policies like the ‘National Mining Policy’ of 1993 further helped the growth of the mining sector.

India’s mineral resources are mainly focused on three geological belts, located at different zones of the country. The mineral distribution from various parts of the country is based on its geological structure, the process of mining, and the time involved in the formation of minerals.

Mining Industry and its Challenges

The mining sector in India including activities like extraction, exploration, mineral deposit identification contributes about 2.2-2.5% of country’s GDP (Gross Domestic Product). But the number is much higher, about 10% to 11% of the GDP, when we include mining projects, exploring unexplored mines, creating employment, and achieving sustainable goals in one way or the other.

The mining sector in India is going through several challenges and disruptions which can hinder its growth. There are many environmental aspects connected to mining activities that challenge its expansion. Most of the these areas are under rural regions, and land issues like use and conversion, water and air pollution, groundwater depletion, waste generation, health issues, and social and cultural issues are some of the major concerns on the national level.

The country is filled with minerals but much of the mineral resources and reserves are forest-covered areas and mining in forests can raise social, cultural, environmental, and health issues for the people staying closer. The Forest Conservation Act, of 1980 was taken into account the impact of mining activities on the environment during the mining extraction and production process, and the legislative forces have been forced many times to shut down mining, affecting production capacity and potential growth.

Due to these factors, there is significantly less growth in the mining sector in India, consequently low contribution to GDP.

Lack of Modern Technology

The mining sector of India suffers from a lack of modernised equipment and techniques for extraction and exploration. The old and traditional method of mining includes the use of simple tools like shovels, pickaxes, hamets, chisels, and pans, for both surface and underground mining. Until the early 1900s, traditional mining was widely used in India.

Whereas in modern mining, equipment like excavators and draglines are used to dig the waste material and expose the mineral reserve. Because mining often happens in the country’s underserved regions, many states don’t own efficient and modern equipment, making no progress in the industry. They still use the traditional mining method to extract minerals.

Including the modern mining practices like excavating machinery, India is still far from global mining practices. Countries like Australia own fully electric mines which reduce emissions, cost of labour, requires less manpower, less environmental impact, and leads faster mining.

India is still in the early stages of adapting to global mining practices such as better data management, technology advancement, and empowering the mining workforce to sustain the industry with long-term benefits.

Increase in Cost

In the auction process of mines, the central government initiates everything in the mining industry. The government selects any mine and can lease it through the auction for specific end-purpose. Once the mine is selected and allocated, the company has to bear heavy taxes and operation costs. There is a lack of further investment and involvement of any private organisations for exploration activities. So, the challenge of mining companies is to build a flexible business that deals with unstable processes, uncertain demands, and threat of product substitution.

Administrative Issues

The mining sector suffers from the low asset and resource underutilisation under the control of public sector units. The auction of mines is under the central government, and once the auction is complete and the mine is ready for lease, the central government hands it over to the state government of that region and gives green signal to proceed with mining. With two governments involved in mining with traders and suppliers, there arises the issues leading to completely pausing the activity or stopping the mining.

Mining companies should be proactive in dealing with internal administrative issues. There are geopolitical issues as well connected to the mining industry. Since the Covid-19 pandemic, colder relations between West and China, European Union instability, war in Ukraine, have affected the mining sector directly and indirectly.

The emergence of new governments and resource nationalism, short-term political instability, and global trade conflicts affected the mining industry. After-effects of instability and trade wars are increased supply chain risks in terms of raw materials, spare parts, technology, and the resultant increased costs. This problem needs a multi-faceted approach that involves traders, governments, suppliers, and trade bodies that ensure the long-term supply chain is sufficiently robust.

“India has 3527 mining leases for 40 major minerals covering an area of 315,986 hectares.”

Mining Capacity in India

India’s mining industry is characterised by many small operational mines. The number of mines reported mineral production (excluding minor, fuel, and atomic minerals) in India was 1319 in 2021-22.

These 1319 mines are located across the country.

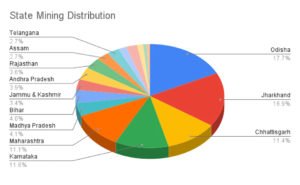

263 mines from Madhya Pradesh, 147 from Gurjarat, 132 from Karnataka, 128 from Odisha, 114 from Chhattisgarh, 108 from Andhra Pradesh, 90 from Rajasthan, 88 from Tamilnadu, 73 from Maharashtra, 45 from Jharkhand, and 39 from Telangana. These 11 states accounted for 93% of the total number of mines in the country in 2021-22.

However, as of 2021-22, the States, that indicated an increase in the value of mineral production are Odisha (94.89%), Jharkhand (90.18%), Chhattisgarh (60.88%), Karnataka (62.22%), Maharashtra (59.30%), Madhya Pradesh (21.92%), Bihar (21.59%), Andhra Pradesh (20.67%), Jammu & Kashmir (18.02%), Rajasthan (19.02%), Telangana (14.29%), Assam (14.45%), Tamil Nadu (9.52%), Himachal Pradesh (12.89%), Meghalaya (6.80%), Kerala (4.30%), Gujarat (3.88%), and Uttarakhand being the lowest at 2.57%.

There are some states which revealed a decrease in the value of mineral production, and those include Goa with -100.00% and Uttar Pradesh with -24.62%.

With the top mineral production, Odisha has substantial benefits state-wide. 94.89% of mineral production equals to the 8.5% of State GDP over the past eight years. It promotes infrastructure development, social development, and high-tech industries. It has been found that the exploration of mineral resources has helped the economic development of the state through employment generation, source of revenue for the government and export promotion.

Jharkhand comes second with 90.18% of mineral production. Jharkhand is a state that is rich in minerals and forest. Its abundance in cheap labour has been quite beneficial for mining activities in both traditional and modern methods.

The state’s mining activities goes from small, completely manual stone quarries to the mechanical mines. With increased mechanisation, the mining industry has grown larger and more powerful. There has been an impact on air, water, forest and land.

The opening of coal mining in Dhanbad in the second half of the 19th century with the establishment of Tata Iron and Steel company in Jamshedpur in Singhbhum district in 1907 marked the beginning of large exploitation of mineral and other industrial resources in this area.

Chhattisgarh leads in iron ore production. The production of iron ore is 5.50 MT per year. Due to massive extraction of iron ore, the area experiences heavy pollution of air, water, soil, and groundwater. The open cast mining of this area which removes top soli cover may invite occurrence of landslides. Rivers such as Shivnath, Indrawati, Hasdeo, Kharron, etc., are found to be polluted due to mining, domestic, and agricultural pollution.

Mineral resources play an important role in the industrial development of the Madhya Pradesh state. The state’s Mineral Resource Department works constantly through conservation, exploration, and continuous monitoring of exploitation of minerals under the rules valid by the Law. Due to the mining activities, though comparatively less than other states, teh adivasi communities in Panna region are losing access to safe drinking water, food, medicine, and other produce from the forest. However, the government feels the mineral production is less and increasing its activities year by year.

The major mining of iron ore in Karnataka takes place in Bellary region, and due to excessive mining, there has been decline of agricultural land to an extent of 43,221 hectares. The increase in mining activities also increased incidence of various diseases in livestock. It increased air and water pollution, and destroyed forests. The area has a high incidence of lung infections, heart ailments and cancer.

Studies say that Karnataka gained a little through mining and lost more.

The Role of Mining in the Western Region

India has to fully explore its mineral resources within its marine territory, mountain ranges, and a few states and regions. For instance, Gadchiroli in Maharashtra has mineral deposits, which were explored only recently. Over the past three years, Gadchiroli region in Maharashtra has emerged as a mineral hub, and it is on its way to becoming a steel hub in India.

With its potential in steel manufacturing, companies like Lloyd’s Metal and Energy Limited have been successful in starting mining operations in 2021. The mines are operated by Thriveni Earthmovers. As they both have received a government push for this activity, the region aims to establish itself as a steel hub by 2030. Such unexplored mines are many in India, and the government of India is taking steps towards sustainable mining in all the areas, explored and unexplored.

Now, the Maharashtra government has been focussing on improving infrastructure like power and water supply, construction of roads, and employment to make mining a smoother activity in this region. The Deputy Minister Devendra Fadnavis in August, 2023 said the government also takes necessary environmental measures to continue mining in Etapalli in Gadchiroli district. According to Devendra Fadnavis, the investment of 20,000 crores has already been approved for mining in this area and more investments are in the pipeline.

Gadchiroli with its investments and necessary environmental measures is on its way to becoming a steel manufacturing hub of India. It has a potential to reduce both cost and overall dependency on steel imports from China. The LMEL company’s current Surjagad Iron Ore mines are set to reach a production of 25 MTPA with the foundations of the Integrated Steel Plant which is underway. Another one, Surjagad Ispat, has already entered the region, and more are sure to follow.

Maharashtra Coal Mines to Undergo Transition

Maharashtra aims to achieve a $1 trillion economy with an energy transition in the next five years. Pravin Darade, the principal secretary of the Department of Environment and Climate Change said that it is certainly a challenge to achieve the net zero target along with the economic growth of India, with mining.

According to the report, there are a significant number of operational mines that are now closed. Further, over 60% of operational mines will close in the next 10 years. Maharashtra is the sixth-largest in coal production. It has a coal production capacity of 88 mmpta and produced 63 mmtpa in 2022-23. The sector supports over 63000 formal and informal jobs in three mining districts, which are Nagpur, Chandrapur, and Yavatmal.

There are two key opportunities for transition in the coal districts of the state. One is repurposing the land available with coal mines and the retired TPPs. Over 42000 ha of land is currently available with operational and closed mines. Besides, over 13000 ha is available with TPPs. A large proportion of this land, 50% is available in blocks that need to go under transition.

Repurposing the retired coal units into industrial parks, green hydrogen plants, and redevelopment provides significant opportunities that support green energy, and industrial development, and maintains climate action state-wise.

Goa’s Downfall in Mining

Goa, the largest contributor of the state revenue with iron ore industries a decade back is now struggling to survive its mining industry. It has been stalled ever since the Supreme Court cancelled 88 mining leases in the state on February 7, 2018. This affected 3 lakh people who are directly and indirectly dependent on mining. Now, Goa is only left with 260 tonnes of iron ore in its reserve for extraction. The quantity available as of March 2021 comprises hardly 4% of India’s total ore reserves.

The mining industry in Goa flourished between 2007 to 2011. Until 2007, it exported 40-42 million tonnes of low-grade ore annually. With the boom of the Chinese Steel market, the state exported over 50-54 million tonnes of ore annually. The Supreme Court’s justice in 2012 made the state suspend all mining activities. The sector that once flourished is today disabled and facing challenges on multiple fronts.

The Highest Mineral Production in India

Steel production and consumption are seen as the measure of a country’s economic development because it is raw material and an intermediary product. Thus, the steel sector has always been at the forefront of industrial progress, which is not at all an exaggeration.

The country stands as the second-largest producer of crude steel with 125.32 MT in FY23. It is expected to grow by 4-7% in FY24. The growth of the Indian steel sector is based on the availability of raw materials such as iron ore, and cost-effective labour. The steel sector has continuously striven for the modernisation of older plants and the upgradation of higher energy efficiency levels. Now, the Indian steel sector is with state-of-the-art mills and modern machinery.

The steel industry and its associated mining and metallurgy sectors have seen a rise in investments and developments in the recent past. Many reputed private organisations are investing in the steel sector namely, Tata Steel, JSW Steel, ArcelorMittal, AMNS India (a joint venture between ArcelorMittal and Nippon Steel), etc. are coming forward with crores of investments to construct steel plants all over the country.

Policy initiatives like ‘Make In India’ have the potential to make the steel industry a manufacturing powerhouse. The steel sector in India depends on other sectors like employment, revenue, overall economic development, and GDP growth. To cut the cost of production, dependency on other countries, India has decided to manufacture steel by itself with abundance of iron ore reserves across the country.

Indigenous availability of high-grade iron ore and non-coking coal are the two key inputs of steel production. A growing domestic and global market also plays a key role behind steel production in India. Though it is the world’s second-largest crude steel producer, the country still lacks in being self-sufficient in production of high-grade steel.

The steel sector in India marks the limited availability of essential raw materials such as high-grade lumpy manganese ore, chromite, coking coal, steel grade limestone, nickel, refractory raw materials, and ferrous scrap. With this perspective, in 2017, the government formulated the National Steel Policy with an aim to create a technologically advanced and globally competitive steel industry that promotes economic growth. This policy aims to achieve self-sufficiency in steel production by providing adequate policy support and guidance to steel manufacturers.

The steel production and the industry alone provides 20 lakh jobs in the country. Due to the rise of electric vehicles, the automobile sector is expected to add steel to its demand. In terms of demand, India is expected to see a huge growth in the coming decade with government initiates like affordable housing in urban and rural areas, expansion of railway network, development of domestic shipbuilding industry, opening up for defence sector for private participation as well as growth in automobile sector.

India Towards Green Mining

Mineral production in India is stepping towards green mining practices to achieve the sustainable goals of the Indian economy. Gradually, mineral production has been increasing in India with the implementation of modern techniques, machinery, and the support of the public and private sectors.

India has initiated green mining techniques within the coal, iron and steel industries majorly. In 2022, Coal India Limited CIL said it is taking a look at green mining options with a vision of minimising environmental impact by leveraging a slew of eco-friendly techniques. Whereas, the iron and steel industry has adopted sustainable sourcing. The sourcing of iron ore and other raw materials sustainably from responsible mining operations helps reduce the environmental impact of steel production.

Out of India, countries like Finland and China also initiated green mining practices. Chinese Coal mines have developed Data Envelopment Analysis DEA to assess green mining efficiency. This is a two stage process in mining. This was involved to assess the efficiency of green mining, the mining efficiency in the first stage, and environmental governance efficiency in the second.

In Finland, the green mining practice came into action in 2011. It was primarily an extension of a sustainable mining model based on five pillars, with focus on resource stewardship, intergenerational equity, minimising adverse environmental and social impact , improving work and organisational practices, and sustainable land use, following mining closure. Finland’s Finnish Fund for innovation launched the Green Mining R&D & I programme in 2011 with a Euro 115 million budget for five years.

Similarly, the Australian mining and metals company, BHP and Vale in North Carolina, USA have been targeting a 30% reduction of emissions from diesel and electricity generation by 2030. Newmont Goldcorp has set up the world’s first electric mine at Borden, Ontario, Canada, indicating a huge step towards green mining practice. Given these practices, the mining is currently under transitory phase, and the four minerals – coal, bauxite, iron ore, and limestone will write a new story between 2050 to 2070.

The efficiency in resources and circular economy can reduce the pressure on mineral resources through structural changes while maintaining growth potential. The mineral resource industry has the potential to contribute to the SDGs such as socio-economic benefits, employment and livelihood, foreign exchange earnings, provision of vital services, development of infrastructure, and supply of raw materials for green technologies.

As a whole, the mining industry is on its way to achieving sustainable goals, focussing on mining practices reducing greenhouse emissions, adopting renewable energy in mining, and integrating circular economy principles. Sustainable mining in India is increasingly vital that is driven by environmental, social, and economic imperatives. Companies are coming forward to invest in green energy solutions and waste management practices to align with global standards ensuring the mining sector has long-term viability and social licence to operate.

Geographical Distribution of Minerals in India

India is the second-largest steel producer, third-largest coal producer, and fourth-largest one in iron production, and holds the fifth-largest position in bauxite production. Here’s the categorisation of the geographical distribution of minerals in India in various regions called belts.

North-Eastern Belt

The north-eastern plateau region covers Chota Nagpur of Jharkhand, Orissa plateau, West Bengal, and parts of Chattisgarh. This region has a variety of minerals such as iron ore, manganese, coal, bauxite, and mica. Over 97% of coal reserves are located in the valleys of Damodar, Mahanandi, Sone, and Godavari. Thus, major iron and steel industries are located in this region.

One of the largest mining companies that operate in the North-Eastern Belt is Odisha Mining Corporation (OMC). It has come a long way since its inception and at one of the top mining corporations now.

The North-Western Belt

The north-western region extends along Aravali in Rajasthan and part of Gujarat. The minerals are associated with the Dharwar system of rocks. Gujarat is known for its petroleum deposits. Both Gujarat and Rajasthan have rich sources of salt, and Rajasthan also has many reserves of non-ferrous minerals such as copper and zinc.

Rajasthan and Gujarat are equally rich in having mining companies that are big and state-owned. From Hindustan Zinc to Gujarat Mining Development Corporation, there are several small companies as well that operate in these two states. Rajasthan is rich in building stones like sandstone, gypsum, granite, marble, and an extensive range of fuller earth deposits. There is a wide range of marble, granite, and sandstone exports to the whole country from Rajasthan.

The mining sector in Rajasthan contributes to the 4% of the state GDP and generates the revenue of 3500 crores. As per 2020, there is 2.8 lakh people employed in the mining. The mining sector and its activities are highly unorganised from not filing mandatory guidelines to not following safety measures. The major issue due to these unsafe mining in this state is health problems of workers.

The Central Belt

The central belt covers Madhya Pradesh, Andhra Pradesh, Maharashtra, and Chhattisgarh regions. This belt is the second-largest one in holding mineral resources of India. This belt comprises large quantities of manganese, bauxite, uranium, coal, marble, limestone, mica, graphite, etc., and the surprising fact is the net extent of the minerals is yet to be assessed.

There are major mining companies that operate in the Central Belt mining region of India. NMDC, incorporated in 1958 as a Government of India fully owned public enterprise, was located in this central belt region. Besides, NMDC is the only organised diamond producer of India from its Majhgawan mine located in Madhya Pradesh. Coal India Limited, Tata Steel, Hindalco, and many such big mining companies operate in the Central Belt region of India.

The South-Western Belt

The southwestern belt extends over Karnataka, Goa, and contiguous Tamil Nadu uplands, and Kerala, showcasing the tapestry of minerals. This belt is rich in ferrous metals and bauxite. It contains coal deposits except the Neyveli Lignite. It has high-grade iron ore, manganese, and limestone. This belt is not as diversified as the north-eastern belt in mineral resources. Kerala has monazite, thorium, and bauxite clay deposits, whereas Goa has iron ore deposits.

There are several small mining companies like KIOCL Ltd, Pacific Industries Ltd, Sri Kumaraswamy Mineral Exports Pvt LTd, etc., in the Karnataka region as it is bigger than Goa in both industrial and mining sector. Goa has many mining companies but the downfall of mining in Goa made the business shut down. Tamil Nadu comes with organised and private mining companies like IBC Ltd, Chennai Traders, Bharat Nirman Limited, and many more.

Mining in Karnataka allows only manual extraction, but there has been machine usage for sand mining. Due to that excessive mining, there has been depletion of groundwater levels and environmental degradation, which are addressed as major issues among the South-Western region. Studies in Tamil Nadu say that the illegal sand mining is the only complex issue.

The one more belt that has mineral deposits is the Himalayan belt. The eastern and western parts of the Himalayas comprises reserves of copper, zinc, lead, cobalt, and tungsten. This belt covers the Assam valley and it has mineral oil deposits.

A look back in time

Mining in India dates back to prehistoric times, 3rd millennium BC during Indus Valley Civilization. Years and centuries later, Milan University discovered a number of Harappan Quarries in archeological excavations between 1985 and 1986. The first mineral mined was flint, which was used for tools and weapons. The mining of copper and gold also dates back to these prehistoric times in India.

The charcoal was also found during prehistoric times, 1800-1870 BC. Metals like Bronze, Copper, and Iron were the ancient minerals. Bronze is dated back as early as 3700 BC. Iron is dated as early as 2800 BC and Copper as long ago was 3000 BC. These ancient minerals talk India’s history, civilization, and legacy back to ages.

Since India’s internal structure is made up of ancient hard rocks, every type of mineral is found here, especially in Gondwana Rocks. Mineral Belts came into the picture by D.R. Khullar. He identifies mineral reserve areas into five belts.

The five mineral belts have mineral deposits, and are the explored and extracted mines of India. There is still so much land that is unexplored and referred to as the country’s economic goldmine.

With fewer resources and high demand, some factors affect economic viability and meet the demand. To meet the demand, a choice has to be made with the number of options available. Thus, a mineral deposit or reserve turns into a mine, reflecting the dynamic landscape of India. The factors that influence the economic viability of mineral reserves include the concentration of the minerals in the ore, the ease of extraction, and closeness to the market.